nc estimated tax payment voucher

D-400V Individual Income Payment Voucher. GET THE LATEST INFORMATION Most Service Centers are now open to the public for walk-in traffic on.

Quarterly Tax Payment Voucher.

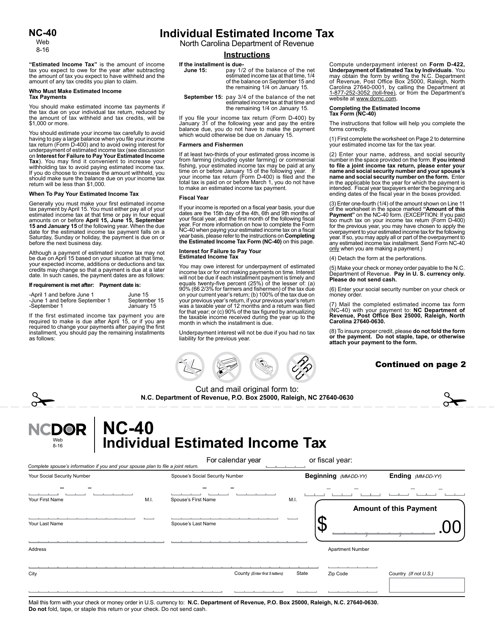

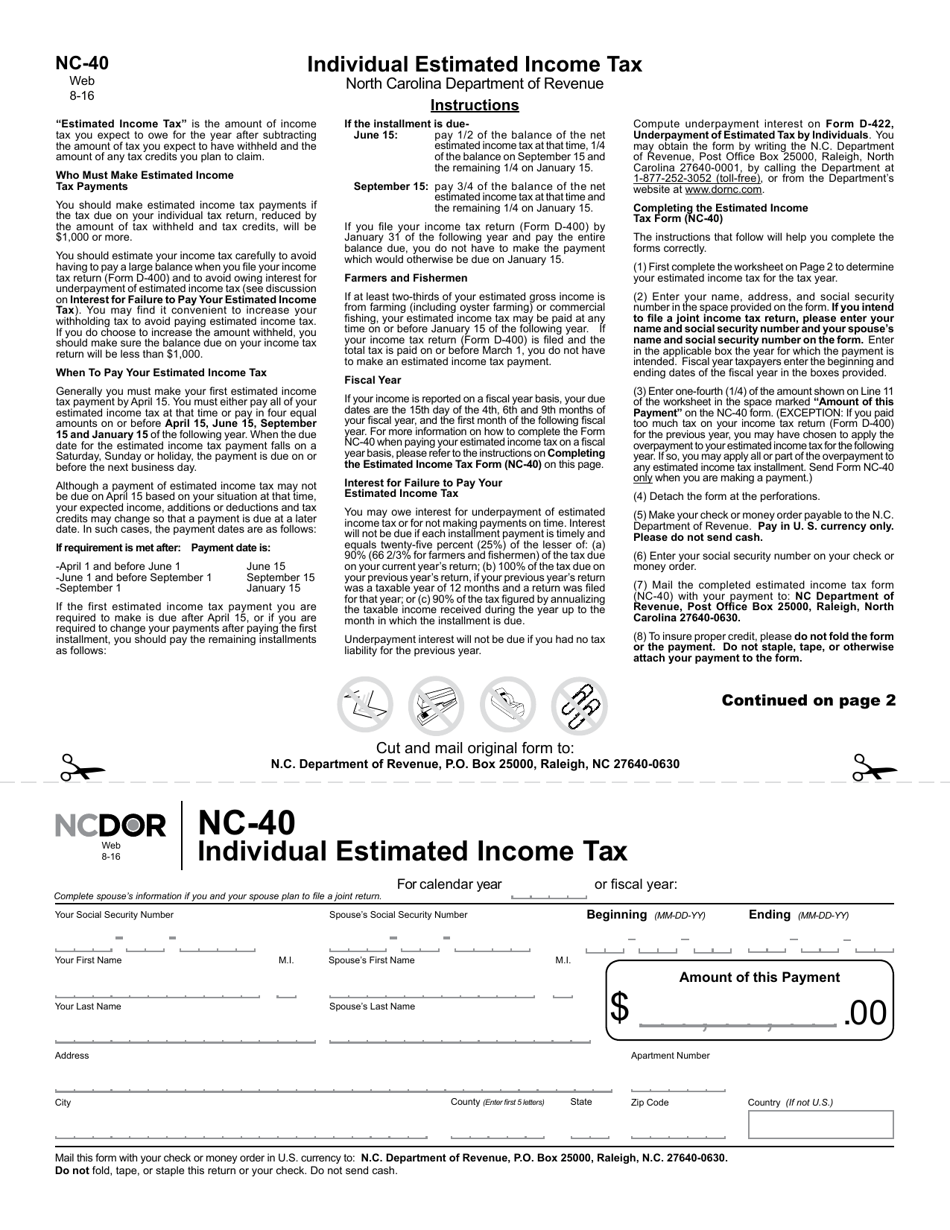

. You can use Form NC-40 to make all of your estimated income tax payments for the year. 2022 Form NC-40pdf. Please fill in the information below sign your name and mail to the address shown.

Form CD-429 Corporate Estimated Income Tax is used to pay corporate estimated income tax. Individual Estimated Income Tax. PDF 23376 KB - January 04 2021.

Want to schedule all four payments. Quarterly Tax Payment Voucher. Nc Estimated Tax Payment Voucher - Bao Magee.

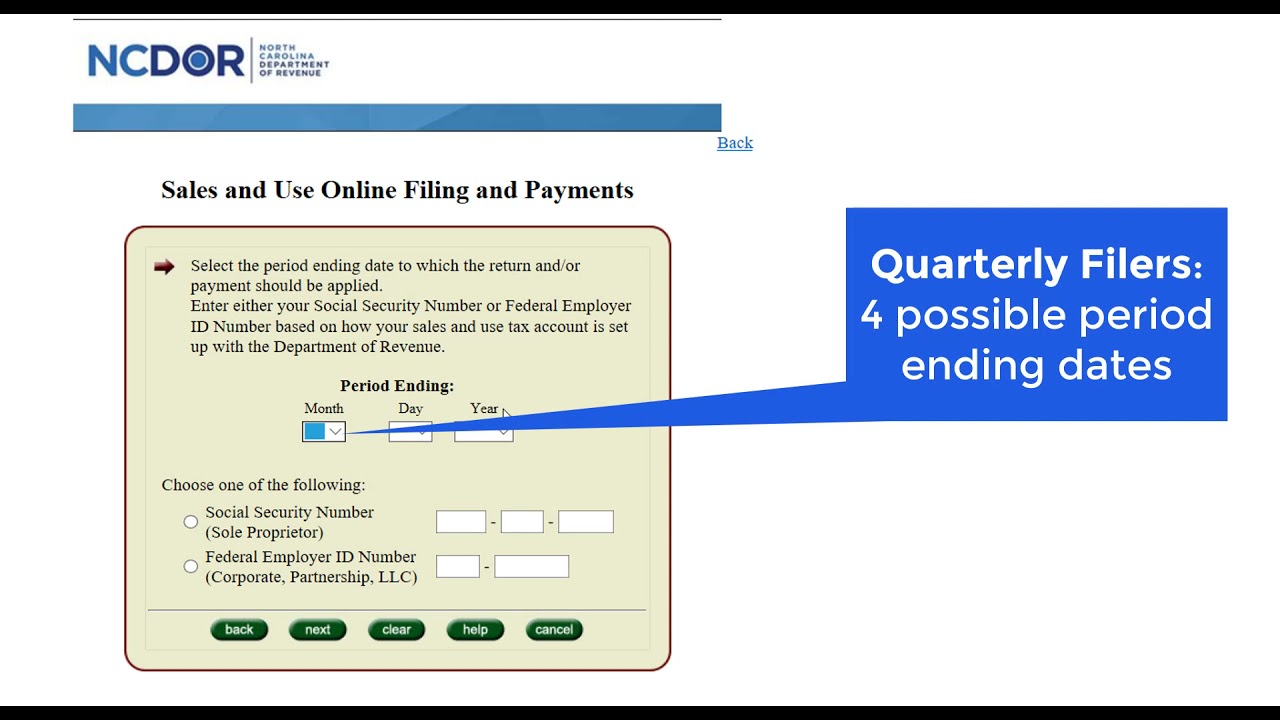

Click here for helpif the form does not appear. However you may pay your estimated tax online. Estimated tax payments must.

Payments of tax are due to be filed on or before the 15th day of the 4th 6th 9th and 12th. For details visit www. Individual Estimated Income Tax-Form NC-40 Individual Income Tax - Form D-400V The Refund Process Pay a Bill or Notice Notice Required Sales and Use Electronic Data Interchange.

Click here for help. Enter Your Information Below Then Click on Create Form to Create the Personalized Form NC-40 Individual Estimated Income Tax. Quarterly Tax Payment Voucher.

Estimated tax payments must be sent. Sign Online button or tick the preview image of the blank. If you have filed Employers Quarterly Tax and Wage Report electronically and you wish to mail in your payment this form must accompany your check or money order.

Schedule payments up to 60 days in advance. Make one payment or. To get started on the form use the Fill camp.

Pay Original Tax Payment CD-V Pay Amended Tax Payment CD-V Amended Contribute to the North Carolina Education Endowment Fund NC-EDU Handwritten Payment or. Complete this version using your computer to enter the required information. Single Married Filing Joint Married Filing Separately Head of Household Widow.

Please note that this is a secure facility. The advanced tools of. PDF 49105 KB - January 24 2022.

Estates and Trusts Payment Voucher. Then print and file the form. NC-429 PTE Pass-Through Entity Estimated Income Tax NCDOR.

DES Central Office Location. Click here for help. Estimated tax payments must be sent to the North Carolina.

Box 26504 Raleigh NC 27611 Quarterly Tax Payment Voucher If you have filed Employers Quarterly Tax and Wage Report electronically and you wish to mail in your. Use eFile to schedule payments for the. Who Must Make Estimated Income Tax Payments You should make estimated income tax payments if the tax due on your individual tax return reduced by 1 000 or more.

Raleigh NC 27611. D-400V Individual Income Payment Voucher. You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding.

To pay individual estimated income tax. D-400V Individual Income Payment Voucher. How to fill out the NC estimated tax payments form on the internet.

Printable North Carolina Income Tax Form NC-40. Click here for help. D-407V Payment Voucherpdf.

PDF 21527 KB - January 06 2022. If so you may. Special rules apply if you are a.

Forms And Schedules For Tax Year 2013 Nc North Carolina

1st 2020 Individual Estimated Tax Payment Extended To July 15 But Not The 2nd Tntax Business Services Inc

How To File Your North Carolina And Federal Income Taxes For Free

Accountant Office In The U S Blank Tax Forms 1040 Estimated Posters For The Wall Posters Accountant Tax Return America Myloview Com

State Returns Estimated Tax Vouchers Direct Debit

Form Nc 40 Download Printable Pdf Or Fill Online Individual Estimated Income Tax North Carolina Templateroller

Online File Pay Sales And Use Tax Due In One County In Nc Youtube

Unemployed People Listen Up How To Pay Quarterly Taxes I Pick Up Pennies

1040 Es 2015 Estimated Tax Payment Voucher 4

South Carolina Tax Forms 2021 Printable State Sc 1040 Form And Sc 1040 Instructions

Form Nc 40 Download Printable Pdf Or Fill Online Individual Estimated Income Tax North Carolina Templateroller

Nc Estimated Tax Payments Fill Out Sign Online Dochub

Quarterly Tax Calculator Calculate Estimated Taxes

How To Make The 2 Estimated Tax Payments Also Due July 15 Don T Mess With Taxes

Tax Withholding For Pensions And Social Security Sensible Money

Federal Income Tax Deadline In 2022 Smartasset

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back